Yo, gold as an investment has been this weird obsession of mine ever since I stumbled into it back in college, like seriously, I was broke as hell living in that crappy dorm in Boston, and I thought buying a tiny gold chain would make me feel rich—ha, joke’s on me, it just sat there collecting dust while my student loans piled up. But fast forward to now, October 2025, I’m chilling in my tiny apartment in Seattle, rain pattering on the window like it’s trying to wash away my bad financial decisions, and I’m sipping this overpriced latte that tastes like regret, thinking about how gold as an investment has kinda been my safety net through all the chaos.

I mean, the history of gold investment goes way back, right? Like, ancient folks in Mesopotamia were hammering it into jewelry around 3000 BCE because it was malleable and shiny, didn’t rust, and just screamed “I’m valuable, yo.” But me? I remember digging through my grandpa’s attic in Ohio last summer, finding these old coins that smelled musty like forgotten dreams, and it hit me how gold’s been this constant through wars and crashes.

Gold as an Investment Through the Ages: My Bumpy Ride Learning the History

Okay, so diving into the gold investment history, it’s like a rollercoaster that makes my own stock market fumbles look tame. Back in the day, gold was money itself—the gold standard ruled until after World War II when countries ditched it for fiat cash, which honestly freaks me out sometimes because paper money feels so flimsy. I tried explaining this to my buddy over burgers in a greasy diner here in Seattle last week, and I totally botched it, spilling ketchup everywhere while ranting about how gold prices tanked to like $35 an ounce in the 1930s, then skyrocketed to $615 in 1980 during that inflation nightmare.

Anyway, from my flawed perspective as this average American dude who’s messed up more investments than I care to admit—like that time I sold gold too early in 2020 and watched it boom—gold as an investment has always been about hedging against crap hitting the fan. Think about the 1970s oil crisis or the 2008 meltdown; gold just chills and holds value while everything else implodes.

H3: Surprising Twists in Gold Investment History That Caught Me Off Guard

Man, one thing that blew my mind—and embarrassed me because I didn’t know it until I Googled it while procrastinating on my taxes—was how gold as an investment got a boost from stuff like the California Gold Rush in 1849, turning regular folks into overnight dreamers, kinda like how I felt when I first bought gold ETFs on my phone app during a boring Zoom meeting. But then there’s the dark side, like governments confiscating gold in the 1930s, which makes me paranoid about my little stash hidden in a sock drawer—seriously, is that safe? I dunno, but it adds this layer of raw honesty to why gold matters; it’s not all sunshine, it’s got contradictions, like how it’s super durable but can still get you in trouble if you’re not careful.

Why Gold as an Investment Still Matters Today: My Real-Life Wake-Up Calls

Fast-forward to 2025, and gold as an investment is hitting record highs amid this government shutdown drama and inflation lingering like a bad hangover. I’m sitting here in my cluttered living room, surrounded by empty takeout boxes from that sketchy Thai place down the street, and I’m thinking, damn, gold still matters because it’s a hedge against all this uncertainty—stocks tank, but gold? It shines, literally. Like, last year when interest rates were flipping out, I cashed in some gold bars I’d impulse-bought after a breakup (yeah, emotional investing, my specialty), and it covered my rent when freelance gigs dried up. But honestly, it’s contradictory; I love how it’s tangible, you can hold it, feel its weight, unlike crypto which feels like vapor, but then I worry about storage—buried it in my backyard once, dug it up covered in mud, felt like an idiot.

H3: Gold as an Investment in 2025: Why It’s My Flawed But Reliable Buddy

Today, with gold prices at like $3,500 an ounce, it’s booming because of central banks hoarding it and investors fleeing to safe havens amid geopolitical mess. From my American viewpoint, living through this endless election cycle and economic wobbles, gold as an investment matters for diversification—don’t put all eggs in one basket, as my mom always nagged. But I contradict myself; sometimes I think it’s overhyped, like when I overpaid for coins at a shady pawn shop in Vegas (long story, involved too much whiskey), yet it still outperforms during recessions. It’s raw, it’s honest, it’s me admitting I ain’t perfect.

Tips on Gold as an Investment: Lessons from My Screw-Ups

Alright, if you’re eyeing gold as an investment, here’s my unfiltered advice based on my blunders:

- Start small, like I did with a few ounces—don’t go all-in like that time I maxed my card on bullion and ate ramen for a month.

- Mix it up: Physical gold for that tactile feel, but ETFs for ease; I learned the hard way when shipping costs ate my profits.

- Watch the market, but don’t obsess—gold’s a long game, not day-trading fodder.

- Hedge against inflation; it’s why gold still matters today, especially with prices surging.

Oh, and research reputable dealers—check out sites like the World Gold Council for deets. But yeah, my learning process involved tears, like selling low during a dip and regretting it forever.

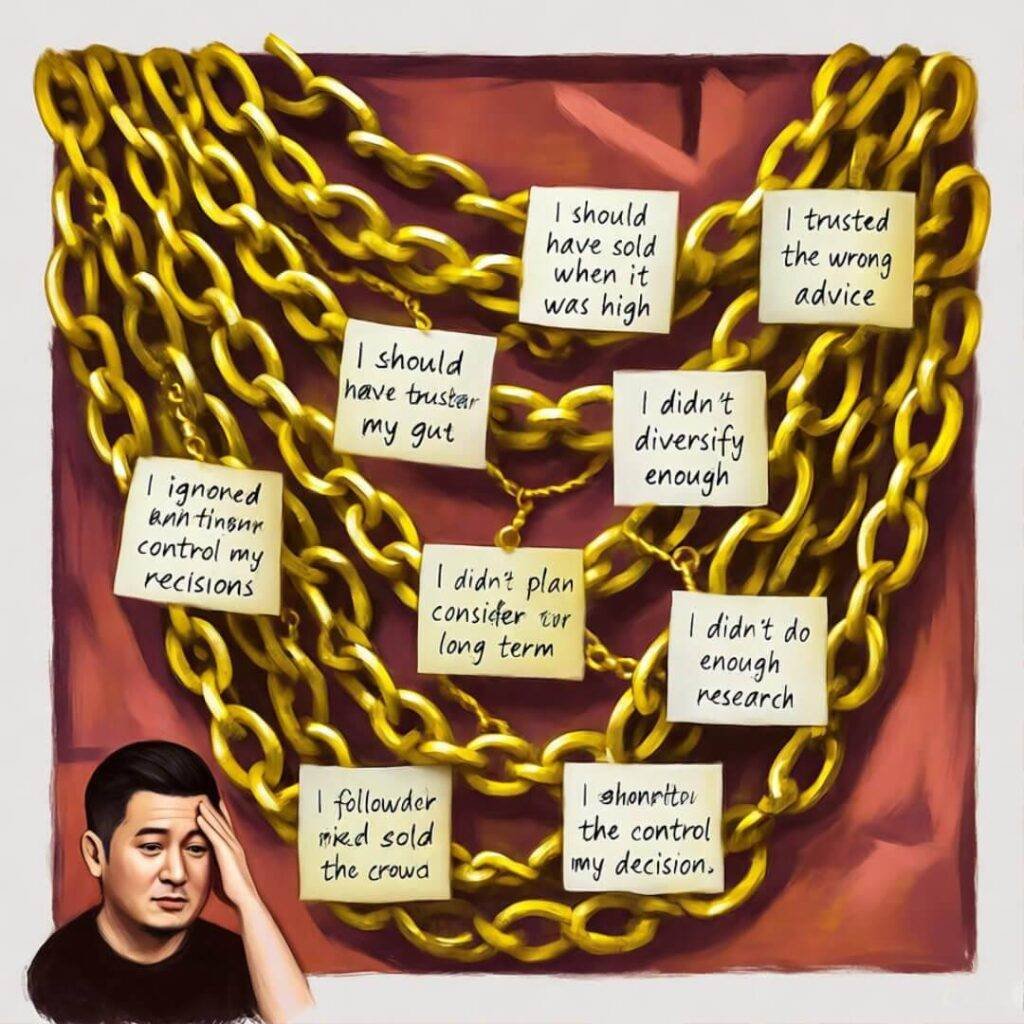

H3: Common Mistakes in Gold Investing That I Totally Made

Number one: Timing the market wrong—thought I was a genius buying in 2023, then prices dipped, and I panicked. Two: Ignoring fees; those storage costs add up, yo. Three: Forgetting it’s not liquid like cash—try selling gold quick when you’re broke, it’s a hassle. Anyway, gold as an investment teaches patience, which I’m still working on.

Wrapping this up like ending a late-night chat over beers, gold as an investment has this epic history and still matters today because, in my messy life, it’s the one thing that doesn’t evaporate when shit gets real. If you’re curious, maybe dip your toe in—start with a small purchase or read up more. Hit me up in the comments with your own gold stories, or check out J.P. Morgan’s insights for smarter takes than mine. Seriously, what’s your take? Anyway, peace out—gonna go stare at my gold stash now. Wait, did I lock the door? Oh man, paranoia kicking in again…